Table Of Content

MoneyGeek ranked the best home and auto insurance bundles for homeowners who want to find the best car insurance in Florida and bundle with a home insurance policy. Still, the best home insurance company in Florida for veterans, active-duty military and their families is USAA. Note that Allstate ranks higher in customer satisfaction, but Allstate’s premium costs about $132 more than Nationwide’s premium.

Chubb: Best for rates and for high-end homes

By avoiding them when possible you can get cheaper home insurance rates. For example, some home insurers have a “trampoline surcharge” to account for the increased risk of insurance claims. NFIP flood insurance policies offer up to $250,000 coverage for your home and $100,000 for your possessions.

Will my homeowners insurance go up if I file a claim?

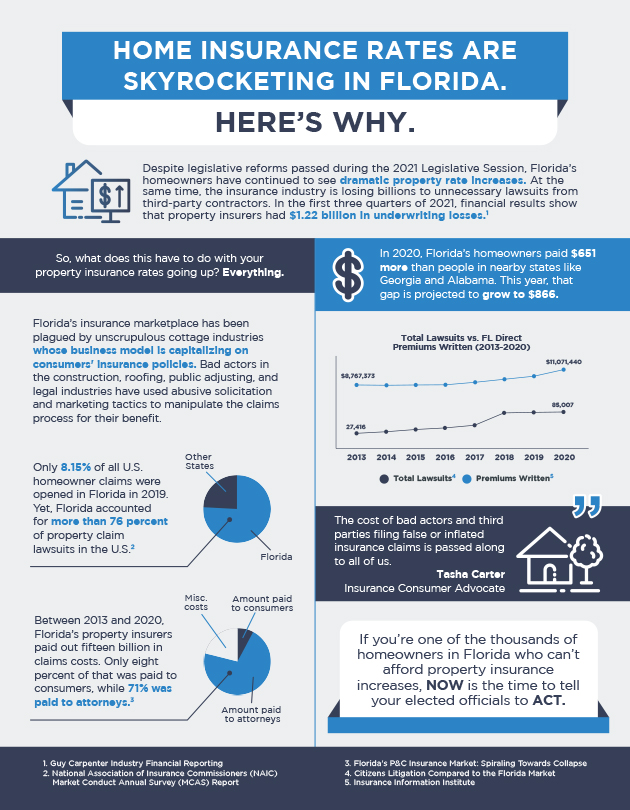

Here, we break down a timeline of Florida's ongoing insurance home crisis and give tips for navigating the complex insurance market as you shop for coverage. The average cost of Citizens home insurance in Florida is $4,658 per year, which is nearly $2,500 more expensive than the annual statewide average of $2,288. All rates based on the above coverage limits except where otherwise noted. Property insurer bankruptcies have left thousands of Florida homeowners scrambling to get new coverage. The Sunshine State has also got the highest number of motivated sellers in the country on real estate marketplace Zillow, according to data on the platform that Newsweek has previously reported on.

Average cost in Florida compared to the national average

Farmers pulls out of Florida property insurance despite efforts to stabilize the market - ABC Action News Tampa Bay

Farmers pulls out of Florida property insurance despite efforts to stabilize the market.

Posted: Wed, 12 Jul 2023 07:00:00 GMT [source]

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Please note that these rates may not include any coverage for hurricane damage.

A ray of sunshine for Florida's troubled residential property insurance market - S&P Global

A ray of sunshine for Florida's troubled residential property insurance market.

Posted: Thu, 20 Jul 2023 07:00:00 GMT [source]

What’s Not Covered by Florida Homeowners Insurance?

Check with your insurance company that you are getting all the discounts you’re eligible for at this time. We recommend comparison shopping with at least three different companies. Request quotes for the same coverage levels from each insurer so that you’re comparing apples to apples. A typical home insurance policy only covers sinkhole damage if the sinkhole leaves a visible hole in the ground and the damage is such that you can no longer live in your home.

Tips for Buying Florida Homeowners Insurance

For nearly a decade, Nick has created content for mom-and-pop businesses and global corporations. As a travel writer, his global adventures have also been featured on Inside Hook, Houston Chronicle, Culture Trip, and Matador. When he's not traveling, Nick can be found in Orlando spending time with his wife and toddler. Nick Dauk is a freelance writer specializing in business, entrepreneurship, personal finance, and travel. His work has been featured in Fox Business, BBC, The Edge, Business Insider, and Bisnow. Nick is a first-generation college graduate, having majored in Interdisciplinary Studies at the University of Central Florida.

Cheap Florida Homeowners Insurance Cost Comparison

You can save hundreds— if not thousands of dollars each year if you shop around for homeowners insurance. Home insurance also includes liability insurance for accidental injury or damage that you do to others. Knowing what home insurance covers in a standard policy is crucial to buying a policy that best fits your needs. Ask your insurance agent how much you can save if you increase your home insurance deductible.

Does Florida require earthquake or flood insurance?

The average cost of homeowners insurance in Florida is $2,625 a year, or about $219 a month, according to a NerdWallet rate analysis. With our easy-to-use online quoting platform, getting a home insurance quote is quick, easy and hassle-free. Simply input your home’s information to find a cheap, affordable Florida homeowners insurance policy for your home in minutes.

Homeowners insurance coverage gives you peace of mind

It's also important to review coverage and premiums once a year, just to make sure nothing has changed or there's not a better deal available. Ensure that your potential insurer has a strong financial strength rating before making your decision. A strong financial rating indicates their preparedness and capability to pay for your claim.

Many homeowners are turning to the “last resort” option, Citizens Property Insurance Corp.. What happens if your homeowners insurance company enters into liquidation within days of a fire damaging your home? Here’s how to file a claim with the Florida Insurance Guaranty Association. “Because Risk Rating 2.0 considers rebuilding costs, FEMA can equitably distribute premiums across all policyholders based on home value and a property’s unique flood risk,” according to FEMA.

A standard home insurance policy (designated as HO-3) covers your house for any mishap that’s not excluded in the policy. Common exclusions include sinkholes, power failure, neglect or wear and tear, nuclear hazard, vermin and insect infestations and intentional damage. In 2002, the Florida legislature created Citizens, a government organization that offers home insurance to Florida homeowners who cannot get coverage elsewhere. Florida homeowners who have lost coverage because their insurers have gone out of business or stopped renewing policies often struggle to find coverage in the private market.

One reason may be that Miami has a higher risk of hurricane damage than Jacksonville. Miami-Dade County also has more than double the population of Duval County. Another reason may be that the Jacksonville Fire and Rescue Department has 64 fire stations serving 918 square miles, while Miami-Dade Fire Rescue has 68 stations serving more than 2,000 square miles. Here you can see how your premiums shift based on varying deductibles for $300,000 in dwelling coverage.

Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. Across the U.S., USAA has a median MoneyGeek score of 95 out of 100 and an average yearly premium of $1,612. State Farm is the overall best company for home insurance in Florida, while Travelers is the best for those on a budget. Your escrow balance is the amount in your escrow account that the mortgage lender uses to pay expenses like property taxes. If you’re looking for mobile home insurance, learn why you need it, where to get it, and what it covers.

No comments:

Post a Comment